Accounting terms are foreign to most people who have not studied accounting, but for a business to run successfully, a certain amount of accounting understanding is required regardless of your job function. Many managers and business owners understand the importance of the words, but not what they mean. Throw in debits, credits, ledgers and journals, and a manager or business owner’s head might start spinning.

A good understanding of accounting is vital to the success of any professionals. It is essential to be able to understand and ask the right questions when reviewing proposal, budgets and financial statements. Perhaps you need to manage a Profit & Loss statement. Or maybe you want to get on top of budgets, or tighten up financial controls. For sales people, it’s often about understanding a prospect’s business better. And how to increase profits. A good understanding of Accounting will help you make better-informed decisions and enhance your professional skills set.

In this article, we will get you started with the most fundamentals of accounting for non-accounting professionals (promise me you will read to the end, because that’s the golden part!) 😉

Understanding the Basics of Accounting in a Traditional Way

The principal equation for accounting is Assets = Liabilities + Owner’s Equity. There are five types of general accounting categorization that you will need to know (Source: Keynote Support):

1. Assets

An asset is an item the business owns and has an economic value. Assets can be grouped according to their physical form into tangible and intangible assets.

Tangible assets are basically things that you can touch and see such as land, buildings, vehicles, equipment, and inventory.

Intangible assets are the assets that cannot be seen and touch but has an economic value. For example, Accounts Receivables, patents, contracts, and certificates of deposit (CDs)

Assets are also grouped according to either their life span or liquidity – the speed at which they can be converted into cash.

Current assets are items that are completely consumed, sold, or converted into cash in 12 months or less. Examples of current assets include accounts receivable and prepaid expenses.

Fixed assets are tangible assets with a life span of at least one year and usually longer. Fixed assets might include machinery, buildings, and vehicles.

2. Liabilities

Liabilities are the debts, or financial obligations of a business – the money the business owes to others. Liabilities are classified as current or long-term.

Current liabilities are debts that are paid in 12 months or less, and consist mainly of monthly operating debts. Examples of current liabilities may include accounts payable and customer deposits.

Long-term liabilities are typically mortgages or loans used to purchase or maintain fixed assets, and are paid off in years instead of months.

3. Equity

Equity basically represents what is left over after you subtract your liabilities from your assets. It can be thought of as the portion of your assets that you own outright, without any debt. (Remember the equation Assets = Liabilities + Owner’s Equity)

Equity may be in assets such as buildings and equipment, or cash. Equity is also referred to as Net Worth.

For example, if you purchase a $30,000 vehicle with a $25,000 loan and $5,000 in cash, you have acquired an asset of $30,000, but have only $5,000 of equity.

Referring to the equation with the example above, $30,000 Asset = $25,000 Liability + $5,000 Owner Equity.

4. Income/ Revenue

Income is money the business earns from selling a product or service, or from interest and dividends on marketable securities. Other names for income are revenue, gross income, turnover, and the “top line.”

5. Expenses

Expenses are expenditures, often monthly, that allow a company to operate. Examples of expenses are office supplies, utilities, rent, entertainment, and travel.

Challenge of Learning Accounting the Traditional Way

We hope that you have managed to read the article till this point. As you realized, understanding basic accounting from reading and lectures are not a feasible way for a non-accounting professional. You may have a lot of question mark or read repetitively on the section above just to comprehend what it was trying to convey (if you managed to fully comprehend all of the above at once, you are a rare genius and fast learner!).

The thing is why torture yourself to learn accounting the hard way when there is an easier and more fun way to learn that number-crunching subject?

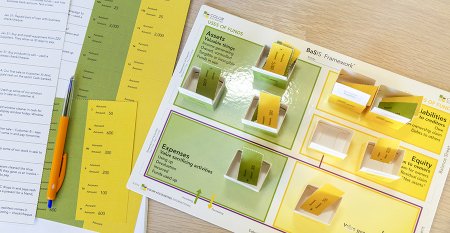

Introducing Color Accounting®

Color Accounting® is a revolutionary new way of learning accounting and finance. It takes the fear out of the subject. People learn better when they can see concepts. The Color Accounting® approach to accounting education is interactive: logical colors, vivid diagrams, plain language, accelerated learning techniques, and even special sound effects, cater to all learning styles.

Colorful diagrams mean that learners are now able to – literally – see how accounting, finance and business work. It’s used by many corporations, agencies, law firms and universities to teach their people how to use financial reports, typically in one day.

Watch the following 1-hour webinar to find out how Color Accounting® can help you to digest the subject easier and in a fun manner!

Now, we can finally ditch the traditional learning of Accounting in black and white pen-paper ink. You can easily pick up this subject with the 3 main blocks of colours: green, yellow, and purple according to the BaSIS framework.

If you are keen to learn more, join us to start the fun way of learning Accounting!